2024 Fsa Rollover Amount. For fsafeds the money stays “separate” until after may and. Employees participating in an fsa can contribute up to $3,200 during the 2024 plan year, reflecting a $150 increase over the 2023 limits.

The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2024. What are the fsa and hsa contribution limits for 2024?

Who Determines The Fsa Rollover Amount?.

What are the fsa and hsa contribution limits for 2024?

2024 Fsa Maximum Carryover Amount:

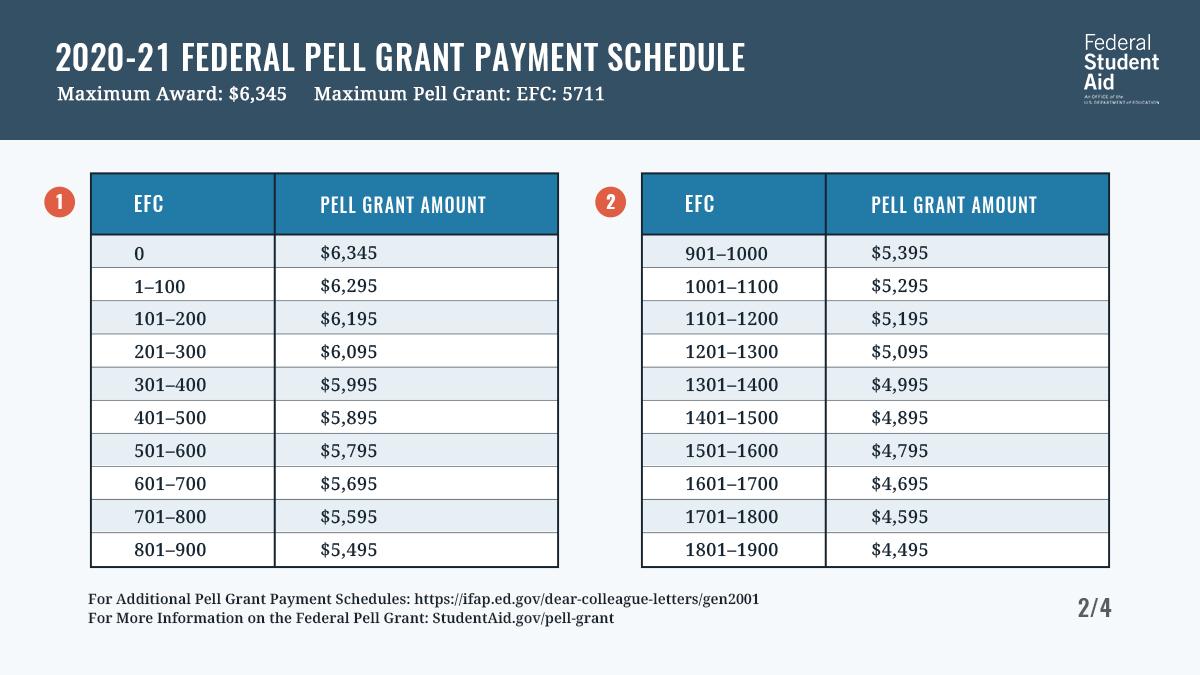

For 2024, the maximum carryover rule is $640 in carryover funds (20% of the $3,200 maximum fsa contribution).

For Unused Amounts In 2023, The Maximum Amount That Can Be Carried Over To 2024 Is $610.

Images References :

Source: holapty.com

Source: holapty.com

Dependent Care Fsa Rollover Tricheenlight, November 11, 2022, 2:17 p.m. October 19, 2023 by whye.org.

Source: yasminwbianca.pages.dev

Source: yasminwbianca.pages.dev

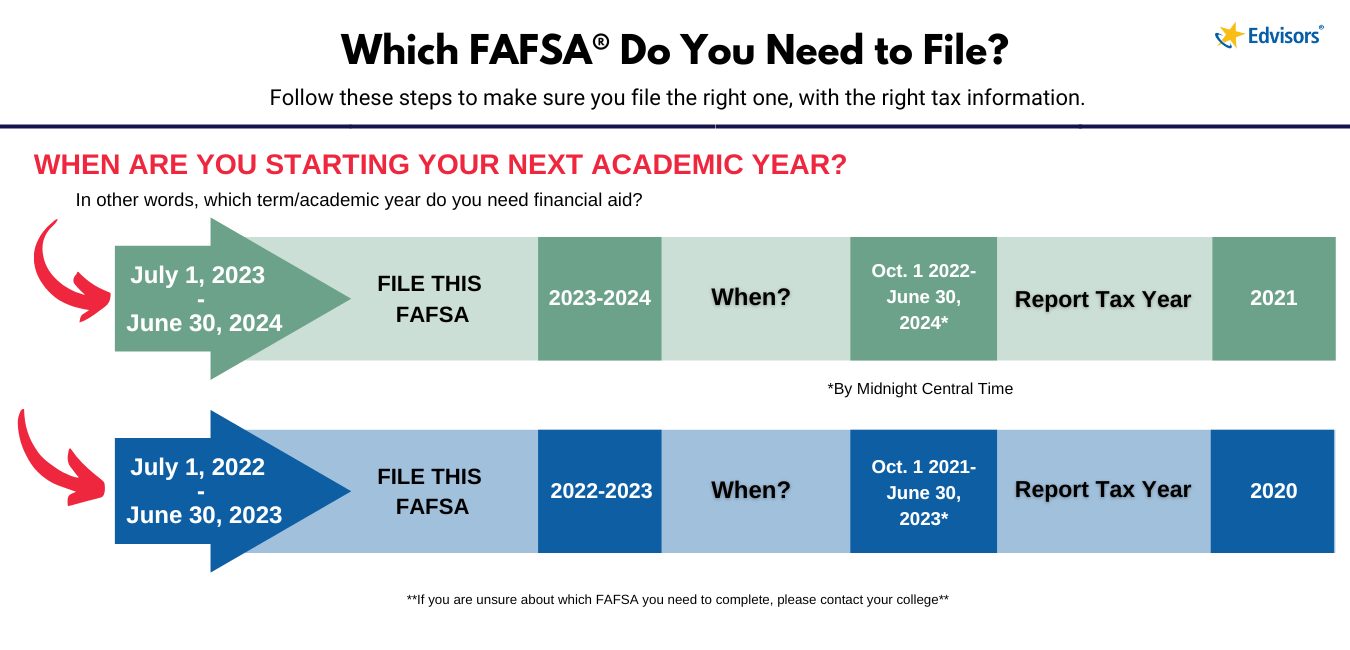

Fafsa 2024 2024 Application Fran Melantha, Department of agriculture (usda) announced loan interest rates for april 2024, which are effective april 1, 2024. So, you can elect up to the plan maximum ($2,750.

Source: www.allaboutvision.com

Source: www.allaboutvision.com

FSA rollover Do my dollars expire? All About Vision, For 2024, you can contribute up to $3,200 to a health fsa. If your company offers an fsa again the following year, account holders can carry over up.

Source: sigridwnicki.pages.dev

Source: sigridwnicki.pages.dev

Fsa Family Limit 2024 Roda Virgie, What are the fsa and hsa contribution limits for 2024? If your company offers an fsa again the following year, account holders can carry over up.

Source: www.youtube.com

Source: www.youtube.com

FSA Rollover & Complying with the Important NDT Compliance Requirements, What are the fsa and hsa contribution limits for 2024? It's important for taxpayers to annually review.

:max_bytes(150000):strip_icc()/Does-money-flexible-spending-account-fsa-roll-over_final-2a963663ba524f5e89bf25dca5f1422e.png) Source: www.investopedia.com

Source: www.investopedia.com

Does Money in a Flexible Spending Account (FSA) Roll Over?, November 11, 2022, 2:17 p.m. Flexible spending account (fsa) eligible expenses.

FSA Rollover Extensions & More Optional Relief BASIC, For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640. Department of agriculture (usda) announced loan interest rates for april 2024, which are effective april 1, 2024.

Source: piercegroupbenefits.com

Source: piercegroupbenefits.com

IRS Announces 2024 Limits for Health FSA Contributions and Carryovers, How do fsa contribution and rollover limits work? 403 (b) and 457 (b) retirement plans.

Source: admin.itprice.com

Source: admin.itprice.com

2023 Fsa Amounts 2023 Calendar, Health flexible spending accounts contribution limit: For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610.

Source: fsastore.com

Source: fsastore.com

How to Budget and Plan Around Your FSA Rollover, Plans that allow a carryover of unspent fsa funds can now permit up to $640 to rollover in 2024 versus the current maximum of $610. Who determines the fsa rollover amount?.

The Irs Recently Announced That Flexible Spending Account Contribution Limits Are Increasing From $3,050 To $3,200 In 2024.

If you don’t spend all your fsa dollars, you might be able to roll over.

What Are The Fsa And Hsa Contribution Limits For 2024?

This is called your “carryover.” in 2024, this.